How do you sell in this market without fear of not knowing where to go?

This is a question many people may have in this insane real estate market we’re experiencing.

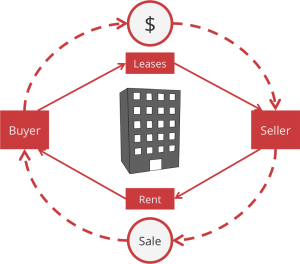

One great option is called a Leaseback.

A leaseback is an option in which it allows a buyer to rent the property back to the sellers, letting them stay in their home for a predetermined amount of time after the closing. This allows you, the seller, some relief from the pressure of finding a temporary place to stay and the stress from moving more than once after selling your home. It also gives you additional time to house hunt!

Leasebacks are often important to sellers for practical reasons, and they are also important to buyers from a negotiation standpoint especially in this extremely competitive housing market giving buyers a bargaining chip to win the offer. The reasons a seller might require a leaseback varies. In this market the main reason is to allow the seller to identify and purchase a new property. Another common reason is that the seller has bought a home but needs to make repairs after the close of escrow to free up some cash.

Leasebacks should always be documented as early as possible with the help of an attorney who will write up a formal occupancy agreement. This will ensure security on both sides. The seller will know that they can remain on the property after closing and the buyers will have an end date and know when he or she can move in.

Terms to consider in that contract are how much the rent should be. Typically buyers determine the monthly rent by calculating the monthly cost of owning the home.

Included in this amount is:

- Mortgage principal and interest

- Homeowners insurance

- Property taxes

Other fees such as homeowners association dues can also be factored in when calculating the leaseback rent. The Buyer will then prorate the amount based on how long the seller will be renting the buyers new home. The amount of time that you'll be allowed to stay in the home is another term that needs to be considered. Typically it's between 1-3 months but that is something that can be negotiated with the buyers based on your need and how flexible they can be.

The third term to consider, is who is paying for the utilities. In most cases, the utilities remain in the sellers name until the leaseback has ended but that can be negotiated prior to closing as well. Aside from money, another important consideration in a leaseback agreement is liability and maintenance of the property. The property will likely be inspected both prior to closing as well as prior to the end of the leaseback period to make sure that no damage was caused to the property.

The last term to consider is whether or not there will be a security deposit in case of any damages to the property. This will depend on the buyer and what he or she deems appropriate.

Leasebacks are on the rise because of this crazy housing market. Even rentals are becoming competitive because many sellers are looking for temporary housing due to homes selling so quickly. There is seemingly very few places to go. But rest assured, a leaseback is a great answer to that problem.

If you have any further questions about leasebacks please call ALANTE Real Estate any time so an agent can answer any of your questions that you may have.

Thinking about Selling?

Find your Dream Home